Introduction

The rise of the fintech sector has redefined the finance world as we know it, creating a more diverse and fairer financial system for all UK businesses, not just the large corporates.

Across the UK, thousands of small and medium-sized enterprises (SMEs) contribute billions of pounds to the local and national economy. While they can be run from as little as a desk in a spare room, SMEs represent 99% (source: House of Commons 2014) of all UK businesses and play a vital role in the drive for economic growth.

The success of small and medium sized business is key to the government's long term economic plan. George Osborne, March 2014 (source: gov.uk)

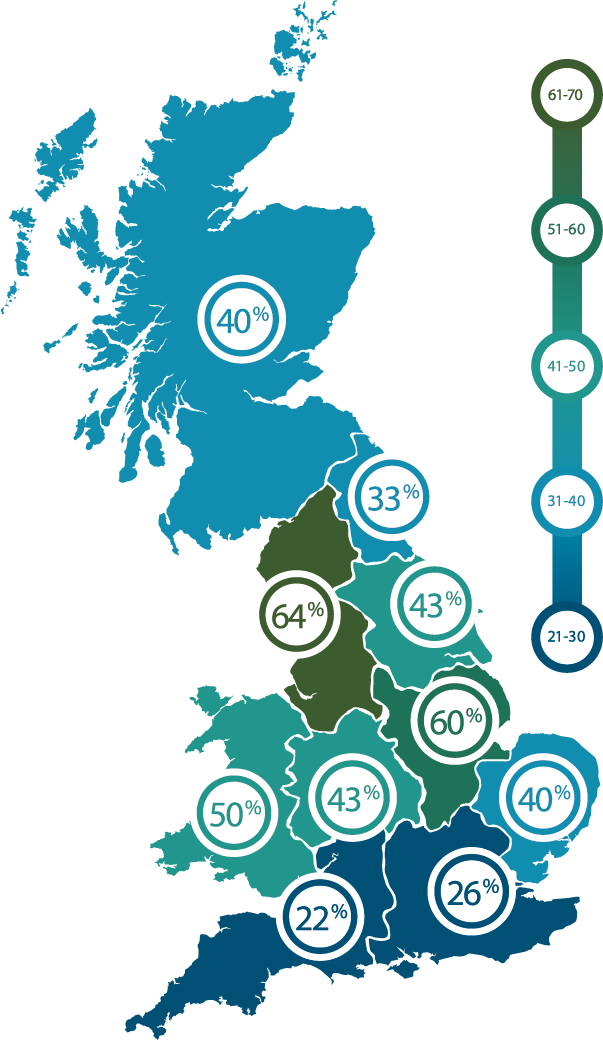

As the visualisation of a survey of over 100 small businesses shows, while there are regional variations, all reported a degree of trouble obtaining funds.

As we’ll explore in chapter 1, this may, in no small part, be because banks are reducing their exposure to the SME market. Yet as you’ll see in chapter 3, the alternative funding sector is on the rise, providing ever-increasing funding opportunities.

So while finding funding can be challenging, there are still plenty of options available if you know where to look.

To help you, this paper looks at bank lending, public funds and alternative finance in detail to provide a comprehensive overview of current business funding. Covering everything from overdrafts and commercial mortgages to government grants and revenue-based finance, you’ll get a good idea of the different funding out there, and how to apply for it.

Bank Lending

While banks have been a source of finance for thousands of years, nowadays they’re increasingly reluctant to lend to SMEs. The very existence of the Bank of England’s Funding for Lending Scheme (FLS) shows how banks need to be pushed and incentivised to lend to UK businesses.

As reported by The Guardian in August 2014, net lending to SMEs by banks involved in the FLS fell between the first and second quarter of the year:

Of the 36 banks participating in the scheme, net lending to SMEs was either flat or worse among 24 banks. The worst figure was at Nationwide, where net lending to SMEs was -£501m in the second quarter, followed by Clydesdale, where net lending was -£439m, and bailed-out RBS, where lending to SMEs was -£360m.

Angela Monaghan, The Guardian Business, August 2014.

The below Bank of England chart below further shows how net lending to SMEs by FLS participants dropped significantly from 2013 – 2014.

While banks have been a source of finance for thousands of years, nowadays they’re increasingly reluctant to lend to SMEs. The very existence of the Bank of England’s Funding for Lending Scheme (FLS) shows how banks need to be pushed and incentivised to lend to UK businesses.

As reported by The Guardian in August 2014, net lending to SMEs by banks involved in the FLS fell between the first and second quarter of the year:

Of the 36 banks participating in the scheme, net lending to SMEs was either flat or worse among 24 banks. The worst figure was at Nationwide, where net lending to SMEs was -£501m in the second quarter, followed by Clydesdale, where net lending was -£439m, and bailed-out RBS, where lending to SMEs was -£360m. Angela Monaghan, The Guardian Business, August 2014.The below Bank of England chart below further shows how net lending to SMEs by FLS participants dropped significantly from 2013 – 2014.

Overview of SME bank borrowing (Q2 2014).

| Borrowing Events YEQ2 14 – all SMEs | Total | All excl. PNBs |

|---|---|---|

| Unweighted base: | 20,044 | 14,106 |

| Type1: New applications / renewal | 7% | 13% |

| Applied for new facility (any) | 4% | 7% |

| - applied for new loan | 2% | 4% |

| - applied for new overdraft | 3% | 4% |

| Renewed facility (any) | 4% | 7% |

| - renewed existing loan | 1% | 2% |

| - renewed existing overdraft | 3% | 6% |

| Type 2: Cancelled / renegotiated by bank | 3% | 5% |

| Bank sought to renegotiate facility (any) | 2% | 4% |

| - sought to renegotiate loan | 1% | 1% |

| - sought to renegotiate overdraft | 2% | 3% |

| Bank sought to cancel facility (any) | 1% | 2% |

| - sought to cancel loan | * | 1% |

| Type 3: Chose to reduce/pay off facility | 2% | 3% |

| - reduce/pay off loan | 1% | 2% |

| - reduce/pay off overdraft | 1% | 1% |

(Data Source: BDRC Continental SME Finance Monitor 2014)

While this downturn in bank funding may paint a bleak picture, banks still lend to some SMEs and offer a wide variety of funding options.

This choice, alongside their presence on your high street, means bank funding may still be a viable option for your business. After all, just because it’s currently harder to obtain bank funding, it doesn't mean that it’s impossible, with some products like overdrafts readily available.

Overdrafts

If you only need a relatively small amount of additional cash, such as £1,500, an overdraft on your business bank account may be a good option.

Advantages of an overdraft

- You only pay interest on the amount you use. So if you go into your £1,500 overdraft by £500, you only pay interest on the £500.

- It can provide fast access to cash. Many banks claim that their overdrafts are easy to arrange, including online or over the phone.

- There’s potential to renegotiate and extend your overdraft when required.

Disadvantages of an overdraft:

- Interest rates on outstanding balances on your overdraft can run 5% or more over the Bank of England base rate, plus 5% or more. Should you go over your overdraft limit the interest rate can shoot up to 25%+.

- There can be an arrangement fee and / or an annual fee, such as 1.5% of your overdraft limit.

- Some overdrafts require security, so entail the risk of asset repossession if you’re unable to keep up with payments. Banks can also reserve the right to call in an overdraft at short notice.

Attaching an overdraft to your business bank account can provide the reassurance that there is a buffer should you experience fluctuations in your turnover or outgoings. Ideally it should be used as an occasional funding source to dip into and pay back, since if you go over your overdraft limit you risk incurring some very high rates of interest.

Loans

When applying for a bank business loan you’re likely to have the choice between a fixed or variable rate of interest.

A fixed rate offers the security of regular monthly payments that are set for a period of time, such as 2 or 5 years, or even the whole length of the loan. This can help with budgeting and planning, as the interest rate is not going to change, so you know exactly what you need to pay back. This can be great for peace of mind, but may mean that down the line your fixed rate is less competitive should interest rates fall.

In the UK, a variable rate usually directly tracks the Bank of England base rate, although the rate you pay may be set to a bank’s own base rate. This means that when the base rate is low, such as the current 0.5%, your loan repayments are smaller than when it’s closer to 1%, 3% or even 5%. As such, there is a degree of risk associated with the loan; should the base rate go up, so will the amount you have to pay back.

Large bank loans

Larger bank loans are usually over £25,000 and can exceed £1 million. This sort of loan can be helpful if you need a major cash injection, for an expansion, recruitment drive or large project to be completed over a period of time. Due to the size of the loan and the security and reassurance the bank will require, these larger loans may be out of reach for your SME if you’re a start-up or yet to see significant profits.

Specialist bank loans

Many banks offer specialist loans to cover the purchase of equipment or vehicles, for instance. The benefit of opting for one of these specialist loans is that you can be very specific about the purpose of the loan, and therefore the precise amount you require and what you need it for. In a financial climate where banks seem reluctant to lend, being able to outline a fixed need, cost and lending period can help your application, as it may be perceived as less risky.

Applying for a bank loan

If you already have a business bank account, book an appointment with your branch’s business advisor to see what your options are. If you’re yet to open a business bank account, do some research into the different loans offered by each bank before opening an account. This is because you often have to hold a business current account with a bank in order to take out a loan with them, so their lending options may influence your final business banking choice.

Many banks offer an online loan calculator, making their websites a great place to start your research. Often you can set your loan amount, rate and term, giving you an idea of the repayments and total interest before you apply. You can then use their online enquiry forms to register your interest and start the application process.

If flexibility is important to you, when conducting your research check:- Is there a penalty for early repayment?

- Can you take repayment holidays?

- Can you pay interest only for an agreed period?

- Are there arrangement fees or exit fees?

Commercial Mortgages

Purchasing rather than renting a commercial property may be a good option for your business if you want to make extensive changes to the layout or function of the building. It can also be beneficial if you want to continue to operate from a specific area and need to secure that location for the long term.

Commercial mortgages can be approved for up to 80% of the value of the property on a term of up to 25 years. They can even include the option to pay interest only, at least for a set period of the loan. As with a residential mortgage, the application process requires credit and other checks and any property used as security may be repossessed if repayments aren’t met.

As with a standard bank loan, it’s a good idea to research the different rates and options online. You can then use a bank’s online enquiry form to register your interest in a particular commercial mortgage to get the application process started.

Getting Bank Funding

Your business' individual loan requirements and credentials will need to be thoroughly assessed. Most bank branches have a dedicated business advisor, so your local branch is a good place to start.

If you already have a business bank account and appointed advisor, book an appointment with them to discuss the loans you may be eligible for. If you don’t have an account, do some research online then book an appointment with the bank you’re interested in. As already mentioned, most high street banks have helpful online enquiry forms, so if you prefer, you can quickly register your interest in a loan without having to go to the bank.

Be aware that if your credit is not excellent and you're looking for funds for a short period of time or you plan to drawdown your funding shortly after your application, bank funding may not be appropriate for you. High street banks face high overhead costs and a tangle of regulation, which means they typically prefer to provide large loans and can take a while to process the applications.

Lenders are likely to analyse your personal credit score as well as your businesses credit report, so it’s good to know where you stand with both.

If you would like to check, visit these resources:

Personal Credit

Business Credit

Public Funds

Before heading to the bank, you may find that public funding is a viable alternative to private funds like those covered in Chapter 1. The UK government has a large number of funding initiatives in place, at national, regional and local level.

Central Government

As part of its remit to encourage economic growth, the government’s Business, Innovation & Skills (BIS) department has made helping people start a business one of its key responsibilities. In fact, in further recognition of the vital role played by SMEs in creating new jobs and trade, one of the top priorities in the BIS business plan for 2014-2015 was:

Some of the government schemes that can help SMEs find finance.

(Data Source: Department for Business, Innovation & Skills.)

| Scheme | Types of Intervention | Aim |

|---|---|---|

| Funding for Lending Scheme | Cheaper borrowing for banks and building societies | More or cheaper loans and mortgages (consumers and businesses). |

| Community Development Finance | Loans to a specific disadvantaged geographic area or disadvantaged group | Varies by institutions. Can include loans to start-up companies, individuals and established enterprises from within that area or community who are unable to access finance from more traditional sources (for example banks). |

| Enterprise Finance Guarantee | Loan guarantee to SMEs | Facilitate additional lending to viable SMEs lacking the security or proven track record for a commercial loan. |

| Business Finance Partnership | Increase supply of capital through non- bank channels | First tranche of BFP funds will be allocated to mid-sized businesses, helping to diversify the channels of finance available to them. |

| Business Finance Partnership: Small Business Tranche | Increase supply of capital through non- bank channels for small businesses | Increase non-traditional finance such as peer-to-peer platforms, supply chain finance and mezzanine finance for businesses with a turnover bellow £75m. |

| Start-up Loans | Loans to help people start a small company | Open up finance to those who would not normally be able to access traditional forms of finance for a lack of track record of assets. |

Our priorities include making the UK one of the fastest and easiest countries in the world to set up a new business. Department for Business, Innovation & Skills. Source: Gov.uk.

As funding is such a key part of getting any business off the ground, BIS runs or contributes to a number of funding initiatives. You’ll find a substantial list of these initiatives, as well as other relevant schemes and resources, on Gov.uk’s finance support finder. It’s a rich source of information and includes details on eligibility and the application process.

Regional funds

In the UK, the rate of economic growth and the opportunities and prospects for businesses varies from region to region. According to the Centre for Economics and Business Research, London’s economy is set to expand by 3.4% in 2015, while in contrast, Northern Ireland will grow by 2.1% and the north east of England by only 1.7% (source: The Guardian, May 2014).

Either to directly address this imbalance, or due to investor interest in a region, there is a wide range of regional funding and advisory services available. For example, the Regional Growth Fund has allocated £2.9 billion of government support to 430 projects across England, enabling local organisations to allocate business funding of up to £1 million. However, the fund is currently under review following the 2015 election, but some money is still available for time-limited projects and small projects. Get in touch with your local authority, Local Enterprise Partnership, banks or even local newspapers that may be distributing the money.

You can use Gov.uk.’s finance support finder to find regional as well as national funds. Simply set the search filters to the location where your business is based.

Local government

When it comes to public funds, there are opportunities right down to city and town level. For example, Sunderland City Council has a dedicated business development team who help businesses find and apply for funds like the Growing Places Fund. Visit your local authority’s website to see if they’re able to offer any funding support.

Specialist public funds

The Innovate UK SMART grants help companies at the early Research and Development phase of a project. This can be particularly useful for SMEs that want to launch with a new science or tech product.

SMART grants are available for:- Proof of market-up to £25,000

- Proof of concept-up to £100,000

- Development of prototype-up to £250,000

There are six application rounds a year, so check the SMART grants site for the latest dates. After each application deadline, submissions are sent for independent assessment. Once completed, the Technology Strategy Board collate the assessors’ feedback and scores to rank the submission and allocate funding. This whole process takes approximately one month after the application round closing date.

Start-up Loans is a government-funded scheme that has lent over £100 million to 20,000 businesses so far. It combines both financial help and mentoring, providing advice right from the beginning of the process.

After submitting a brief summary of their business idea on the Start-up Loans site, applicants are paired with a Delivery Partner who will help them put together a plan. Once the Delivery Partner is happy that the business plan is clear, with numbers that stack up, it’s considered for funding.

Should the funding be approved, the applicant is then paired with a mentor to guide them as they start their business. This dual funding and mentorship approach can be particularly helpful if your start-up is in a field you’re less familiar with, or if you’ve had no experience of running your own business.

Outset Finance is a Start-up Loans delivery partner that helps with the loan application process.

When applying for a loan through Outset Finance, applicants can also access Outset Online, which offers tools, workshops and other resources for creating a business plan. When ready, applicants fill out a detailed online application form and provide supporting documentation, such as bank statements and a personal survival budget. Outset Finance then manages the application process and successful businesses will be credited with the loan within 2-3 working days of approval.

Applying for public funds

As part of their comprehensive SME access to finance schemes guide, the Department for Business, Innovation & Skills suggest four key places to start when applying for public and other business funding:

Business Link Helpline

Business Link is a government-funded business advice and guidance service in England.Call 0845 600 9 006 for advice and information on financing your business.

Business Finance and Support Finder

A tool for finding publicly funded sources of financial assistance.Business Finance for You

A source for finding a wide range of finance providers from across Britain.SME Finance Guide

The Institute of Chartered Accountants and Business In You (part of the Department for Business, Innovation & Skills) has put together a guide to SME finance.Grant Tree

Grant Tree makes it easier for small businesses to find public funding that may be appropriate to your specific circumstances, and helps you through the application process.

Alternative Finance

Alternative finance providers are increasingly stepping in to fill the void left by a decline in traditional bank lending.

Sectors like crowdfunding and peer-to-peer lending platforms are leading the way. In their wake have emerged other new forms of finance that challenge our traditional understanding of bank finance. These alternative finance providers are currently seeing a continuous increase in engagement, as more businesses seek new financing solutions.

We’ll work through this chapter as your growing business might move through different stages of finance, starting with sources that can be used for start-up businesses, then moving through to facilities for businesses that have been established a little longer, and finishing with resources that you might want to use repeatedly, or once your business is somewhat more mature.

Crowdfunding

Rather than applying to a single source for one large sum, with crowdfunding businesses get a small amount of money from lots of different people to raise the capital they need. Crowdfunding is a rapidly growing industry, with the number of investors and amounts raised increasing year on year. 2012 saw the first crowdfunded project to raise £1million (source: UK Crowdfunding) and in Q1 of 2014, an average of 325 crowdfunding projects were launched each day, with $124million raised (source: The Crowdfunding Centre).

These crowdfunding sites turn the traditional funding method on its head: rather than a business seeking £5m from one wealthy backer, it can raise the same amount from half a million people all pledging £10. Emma Simon, The Telegraph Finance

Getting crowdfunding

(Rewards & Equity)

Even if you’re an early-stage business, adding your project to established crowdfunding sites, like Kickstarter or Indiegogo, can quickly connect you with thousands of potential investors. For example, one of this year’s standout Kickstarter success stories, Coolest Cooler, attracted 62,642 backers in fewer than two months, raising $13,285,226.

While it’s quick and easy to add your project or business idea to a crowdfunding site, it’s important to first consider your strategy and pitch. You should also establish whether a rewards-based or equity platform would work for you.

As well as a source of finance, crowdfunding, particularly rewards-based, is a great testing ground for your product. If your product or service struggles to attract backers this could be a sign it won’t sell once launched, or it suggests that you might want to build up a bigger base of support first. Therefore, when putting together your crowdfunding page, think marketing. Don’t just explain your idea, but include quality video and imagery to showcase your project. Convey all the features and benefits just as you would if you were launched and selling. Not only does this give you the best chance of attracting interest, but it will show up a fundamental flaw in your offering if there’s little interest even after your best sales pitch.

You should also get some feedback on your pitch and product before launching your crowdfunding application, such as from an industry peer. Michael Wolf in Forbes business magazine suggests that:

By getting some sober market feedback before hitting the launch button, you can help your chances of success. And, in the case your product wasn’t quite as different as you thought it was, you also give yourself an opportunity to work on it and make it better before hitting submit...your campaign really only has one chance. Once you let the cork out the bottle, there’s no putting it back. Source: Michael Wolf in Forbes business magazine September 2014

Ask yourself:

- Can your business offer an inviting reward? Is this reward scalable to attract both smaller and larger investments?

- Is equity crowdfunding a better option? What percentage of your company would you be willing to part with? Why is your proposition compelling to investors?

- For either equity or rewards-based, how are you going to sell your business? Do you know what your USPs are, and what would interest investors? Remember, those using rewards-based crowdfunding may have little or no business knowledge, and those looking to buy equity will be meticulous in their analysis of your company.

Once you’ve built your business past the point at which you would need to offer rewards or sell equity in return for investment, you might be looking for debt funding. This is because there are many reasons you might want a loan; from growth to refurbishment.

Getting crowdfunding

(Debt)

For more established businesses, debt crowdfunding might be available in some instances, but before you consider speaking to a platform like Funding Circle, there are a few things to keep in mind:

- Your annual turnover should be over £50,000, preferably closer to £100,000

- You should have at least 2 years’ formally prepared and filed accounts, ideally with a recent profitable year

- You should not have any County Court Judgements (CCJ), and certainly none above £250

In many cases it is said that the requirements for debt crowdfunding – p2p finance – can be as rigorous as banks. This may be true in some cases, but likely not all. Additionally, it’s typically much faster to go this route, and rates can be at least as low as the high street banks.

Crowdfunding of any variety isn’t going to be ideal for all businesses. The sector is growing tremendously quickly, and although it can offer a very attractive alternative to banks or business angels, it won't serve all businesses equally well. In case it’s not for you, we’ve compiled a few summaries of other types of alternative finance in the pages ahead.

Spotlight on Funding Circle

One of the major players in this sector is Funding Circle, who’ve recently received extensive government funding:

In March 2013, the government began lending £20m to small UK businesses through Funding Circle, as part of its business finance partnership scheme. Source: Funding Circle

You can apply online for an unsecured business loan through Funding Circle and will be advised of the decision within 2 working days. If your application is successful, within 7 working days your loan will be listed on the Funding Circle marketplace. Here investors bid on your requested loan, not only pledging the amount they’ll lend but also the interest rate. Once bidding is complete and the lowest interest rates have been accepted on the loan, the business makes monthly repayments that are distributed to investors.

Pension-Led Funding

As the name suggests, pension-led funding makes use of funds held in UK registered pension schemes. Specifically, capital is released from funds locked in business owners’ pension plans. For example, pension-led funding helps business owners or directors seeking funding to establish a Small Self-Administered Scheme (SSAS) or Self-Invested Personal Pension (SIPP) scheme, then transfer some, or all, of their pension funds into it.

The pension-led funding approach also enables businesses to leverage the value of their intellectual property (IP). Based on an independent IP valuation, the IP can be purchased or leased by the pension fund or it can be used as security for a loan from the pension fund to the business.

Pension-led funding can be used as a source of working capital, to purchase commercial property or equipment, and for acquisition and expansion.

Getting pension-led funding

As the source of finance is the business owner’s own pension fund, this option is only really viable for people with a sizeable pension pot, such as over £50,000. This could come from a number of different pension sources, for example, several individual personal pension funds could be consolidated into a new SSAS.

According to the funding options, pension-led funding takes about 6-12 weeks to obtain. There are a number of service providers, the best known of which is pension-led funding. The lender will let you register your interest or requirements online, though the actual due diligence and drawdown process will be very manual, as you work toward releasing the funds from your pension into your business.

Unsecured Business Loans

Banks and other lenders often use collateral, such as a house or assets that your business may own, to secure a loan. In the event of a default the lender can then take ownership of the asset, thus ensuring that they’ll be able to recover at least part of their investment. Logically, then, unsecured loans are not backed by collateral but are instead based on the applicant’s credit history and the performance of the business.

If you run a small business without much in the way of security, finding an unsecured loan provider could be a good option. The amounts available tend to be on the small side – it may be difficult for big projects, but again, for short-term solutions, it could be ideal.

In fact, crowdfunding platforms – like Funding Circle – are good examples of unsecured loan products.

Because peer-to-peer lenders operate online, linking lenders and borrowers directly, their margins are thinner than those of high street banks, which means rates for borrowers and lenders are attractive.” Elaine Moore, Financial Times, February 2014

This lower cost isn’t necessarily true of all unsecured loan products available, however. Because the lenders have no guarantee in the way of security the cost of borrowing is often higher than banks. Many lenders, though, have realized that, as counterintuitive as it sounds, cost is not always the most important consideration when it comes to funding.

Spotlight on Fleximize

Caroline Newling-Ward, owner of Lancombe Country Cottages & Lodges, found that Fleximize’s flexible approach worked for her business. Having turned a derelict site into a stunning holiday complex set in the heart of Dorset, she needed easy access to working capital to grow her business.

I would recommend Fleximize to any business. After dealing with Banks all my life, I was nervous about using an alternative option. However, I found the process more expedient, very professional, and the pragmatism with understanding my business and applying that to the company’s demands and needs was second to none.

There are several other reasons that businesses do turn to unsecured loan providers, even given the cost differential with banks. In many cases, the business has not got security to offer from the business – in other cases, a business owner might just not want to put up his or her business property as security for a loan. Additionally, because large parts of the process are automated and streamlined, many short-term unsecured loan providers can provide finance within hours or days. If there is a great opportunity for a limited time, speed is of the essence!

Finally, in addition, these lenders are typically easier to use – they tend not to ask for business plans or cash flow forecasts, but rather look at the historical performance of the business to predict the future. Though this also means that they offer lower amounts than banks.

If cost is your primary concern, short-term unsecured lending is probably not for you. There are, however, a number of other reasons that this sort of financing might suit your business well.

Revenue-Based Finance

The primary difference between revenue-based finance (RBF) and most other forms of debt finance is the way in which borrowers repay under RBF. Instead of your repayments being linked to an interest rate, they’re based on a percentage of your profits.When arranging revenue-based finance, the business and finance provider agree:

- The total amount to be repaid

- The percent age of revenue to be shared with the finance provider

- The payment frequency, such as weekly or monthly repayments.

So for example, if you borrow £25,000, your monthly turnover determines your loan term and your payments will align to an agreed percentage of your monthly sales. Therefore, if your turnover is £50,000 for one month and you have agreed to repay 10% of your monthly sales each month, you would pay £5,000. If it goes down to £45,000, you pay £4,500. This continues until the agreed amount is repaid. Paying a percentage of your revenues means your loan repayments are likely to fluctuate each month. As the final repayment amount is agreed from the outset, it might take a slightly different mindset to grasp how to budget. It’s relatively simple; in this instance, the business would just have to keep an agreed 10% of sales aside to repay the advance. A lender will add interest to the loan, and this can vary, depending on each provider.

Invoice Discounting

Should you need a helping hand with your company’s cash flow, invoice discounting can be a good option. This is because it enables you to release money based on your outstanding invoices before they’ve been paid by your customers.

How invoice discounting works:

- The invoice finance provider will buy your trade debts (unpaid invoices) at an agreed rate

- Discounters typically advance 80% to 85% of the face value of valid invoices, so if you’ve raised invoices worth £50,000, based on an 85% advance you could release £42,500 almost immediately

- It can be a one-off or longstanding arrangement, with the financer continuing to provide the 85% advance based on the value of any new invoices, with the remaining 15%, minus any fees or interest, paid to you when the debtor fulfills the invoice.

As opposed to taking out a loan when your future revenues and profits are unknown, one key benefit of invoice discounting is that it’s based on money that your business is already owed.

Invoice discounting frees up this locked-in capital and allows firms to concentrate their efforts on the day-to-day nuts and bolts that make their business a success. This means that rather than waiting months to be paid, SMEs can access funds within a couple of days, which enables them to grow their business without having to wait for invoices to be settled. Andrew Hagger, The Independent, September 2014

Invoice factoring and invoice discounting can be provided through traditional high street banks. In general, though the amount released on an invoice can be relatively low, while the rates for using the facility can run quite high. There are a number of specialist lenders in the industry, too. The best known and oldest non-bank supplier is Bibby, while the one making the most noise at the moment is Market Invoice, which takes principles from crowdfunding and peer-to-peer finance to release money held in unpaid invoices.

Spotlight on Market Invoice

Founded in 2010, Market Invoice adopted principles from the peer-to-peer finance space to provide a single-invoice discounting service to British SMEs. Market Invoice, therefore, acts as a platform that connects businesses with institutions or wealthy individuals willing to buy their invoices (much like a bank would), but can very often do so much faster than a bank and do not charge the same ongoing facility fees that a bank might. The company has seen enormous growth over the past few years, as small businesses come to appreciate the speed and flexibility of the finance offered. The company summarises their service below:

We help ambitious, fast-growing businesses fulfil orders and take advantage of potential market opportunities. Our finance product gives quick access to funds, as well as the flexibility to use us only as and when they need to.

Summary

Bank funding has arguably become more difficult since the Great Recession. In many instances – given banks’ high overheads – small loans haven’t made any commercial sense. However, there are reasons for small businesses to be hopeful. As finance moves further into a digital space, those overheads decrease, increasing the likelihood that borrowers can find funding from a number of sources.

New businesses are also disrupting the way in which loans have been distributed – instead of a bank channeling money to borrowers, a single borrower can receive money from hundreds of backers. This can either be repaid by sharing the borrower’s product, selling equity, or paying an interest rate on money received.

In addition, the number of alternative finance providers in Britain is increasing rapidly. If your business is highly dependent on large contracts that only payout on 30, 60 or 90 day terms, there are invoice discounters that will help you release that money. If you have money in your pension that you’d like to invest in your business, others can help with that. If you have highly valuable assets, or need to purchase highly valuable assets, asset-based funders can help with that. Or if you don’t have the long history and security required by banks, but a healthy revenue stream, revenue-based funding will help you leverage your monthly revenues to pay your loan in a way that reduces risk.

Your options abound; it will all take a bit of research and preparation, but SMEs in Britain are in an excellent position to ensure that they’re not held back by a reduction in high street bank lending.

Helpful Resources

Better Business Finance

An impartial information and support service for SMEs. Managed by the British Banker’s Association (BBA) in collaboration with partners like the Department for Business Innovation & Skills, Better Business Finance can help you find a finance provider.

Link: Better Business Finance

Business Is Great Britain

Business Is Great Britain is a new government site that provides support and advice for both emerging and established businesses. Sections include finance options for new businesses and a business support finder. There are plenty of case studies, from new markets to women in enterprise, making it a great source of inspiration too.

Link: Business Is Great Britain

Gov.uk

The central source of government information and services. The extensive business section includes funding opportunities, as well as policies and guidance.

Link: Gov.uk

Finance Reports

The Department for Business, Innovation & Skills’ SME Access to Finance Schemes Report summarises the main forms of public finance and advice available to businesses.

SME Finance Monitor

A survey of 5,000 businesses conducted every quarter

www.sme-finance-monitor.co.uk/

Market Overviews

Business Finance Explained from Gov.uk

www.gov.uk/business-finance-explained/overview

Money Supermarket’s loan guides and comparison tool

www.moneysupermarket.com/loans

Crowdfunding Platforms

Kickstarter

Indiegogo

Go Fund Me

Funding Circle

Revenue-based Finance

Fleximize

Invoice Discounting

Market Invoice

Charts by: Highcharts.com